First Step Of Your Journey: How To Calculate Child Care Subsidy?

Navigating the world of childcare benefits in Australia can be overwhelming, especially for families with multiple children. Fear not! We’re here to break down the details for you and showcase how much you can save under the Child Care Subsidy (CCS) for 2024. Plus, we are introducing our New Child Care Subsidy calculator to simplify the process for families with multiple little ones.

Check out our CCS guide to learn everything you need to know about Childcare Subsidy.

Understanding Child Care Subsidy (CCS)

What is CCS?

Child Care Subsidy (CCS) is a government assistance package designed to financially support families using Early Childhood Education and Care services. It covers various childcare services like Long Day Care, Before School Care, After School Care, and Vacation Care.

Eligibility:

- care for a child 13 or younger who’s not attending secondary school, unless an exemption applies

- use an approved child care service

- be responsible for paying the child care fees

- meet residency and immunisation requirements.

How Does CCS Work?

Once eligible, the subsidy is paid directly to your childcare provider, reducing out-of-pocket expenses. The amount depends on your family’s circumstances and the activity test results.

Higher Child Care Subsidy

If you qualify for CCS and have more than one child aged five or under, it could further decrease your out-of-pocket expenses for childcare services. Here’s the list of requirements for the “Higher Child Care Subsidy.”

- Eligibility for CCS

- Family income under $362,408

- More than one child aged five or younger in childcare

CCS rates for higher-rate children:

Learn more about higher CCS on the Service Australia Website

Let’s Calculate How Much You Can Save!

Calculating the correct CCS rate for each child involves considering several factors. Worried about making errors? Our Child Care Subsidy calculator is here to help estimate potential savings based on your family’s unique circumstances. Follow the simple steps below to generate an overview of your CCS rate swiftly.

1: Select your current position

2: Fill in your income

3: Select a centre and number of days per week that you prefer

4: Fill in an email address to receive your results

Now, your CCS estimation results are on their way to your email inbox. If you have any lingering questions about the Child Care Subsidy, simply fill out our inquiry form. Our team is ready to connect with you and provide all the additional details you need.

Learn More About Child Care Subsidy

Activity Test

The hours of subsidised care depend on the hours of recognised activities you engage in. To find out more information, please check out our blog: Guide to Child Care Subsidy and Rebate.

Income Test – 2023 Updates

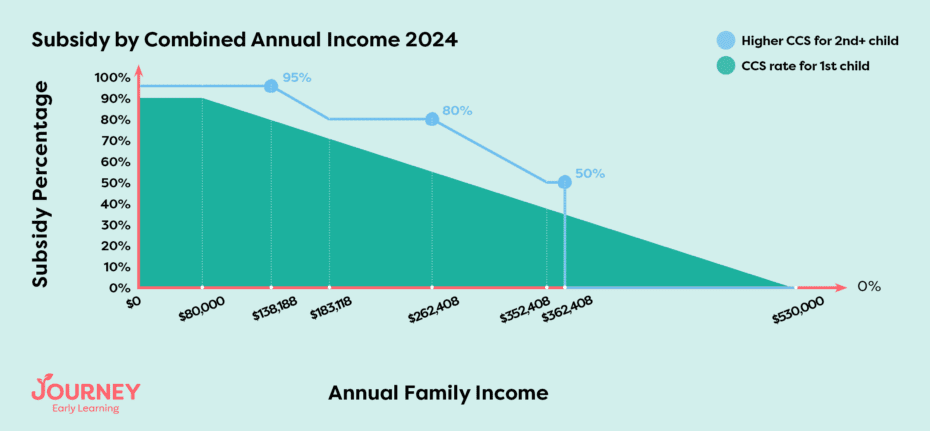

- Maximum CCS rate increased to 90% for families earning $80,000 or less.

- CCS rates increased for families with a child in care earning under $530,000.

If the family’s combined income is more than $80,000 to below $530,000: the CCS percentage goes down by 1% for every $5,000 of income your family earns above $80,000

Additional Child Care Subsidy

Families facing unique circumstances (e.g., grandparents, job transition, or temporary financial difficulties) can apply for ACCS.

Examples of Various Circumstances

Families with one child:

Charlotte has one child, Flynn aged 8 who attends Outside of School Hours (OSHC) at their local child care 3 days a week. Charlotte’s family income estimate is $75,000 for the year.

Flynn will get the maximum standard CCS rate of 90%. This is because they’re the only CCS eligible child in care and the family income is under $80,000.

Families with one or more children aged 5 or younger and attending care:

Carmel and Ali have two children aged 5 or younger, Mauve and Xena, both attending Centre Based Day Care at their local centre. Carmel and Ali have a combined family income estimate of $70,000 a year.

Mauve is aged 5 and considered a ‘standard rate child’. Xena is aged 2 and considered a ‘higher rate child’. The family is eligible for a higher rate of CCS because both apply:

- they have 2 children aged 5 or under attending child care

- their combined family income is under the $362,408 higher rate of CCS income limit.

The family will get a standard CCS rate of 90% for Mauve and a higher CCS rate of 95% for Xena.

Families with one or more children younger than 5 and one older than 5:

Andy and Chris have two children, Sienna and Jules. Andy and Chris have a combined income of $95,000 a year.

Sienna attends Outside School Hours Care (OSHC) at their local child care. Jules goes to family day care. Sienna is 6 years old and Jules is 3 years old. Andy and Chris do not qualify for a higher rate of CCS because they do not have two children aged younger than 5 attending child care.

Based on their family income, Andy and Chris will get a standard CCS rate of 87% for both Sienna and Jules.

Start Your Journey with Journey Early Learning

Looking for professional and recognised childcare? Journey Early Learning is here to guide you. Our mission is to help every child embark on life’s journey in the best possible way, offering fun and engaging learning environments. Our experienced Early Childhood Teachers are ready to inspire your child every day.